Product depreciation calculator

You can enter in an item into a table select a. The fundamental way to calculate depreciation is to take the assets price.

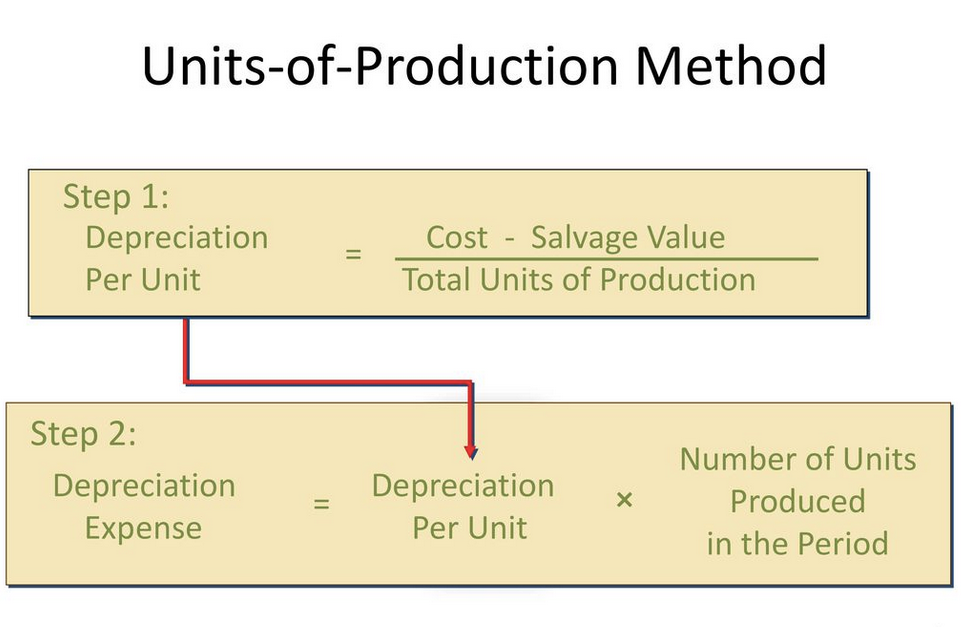

Calculating Depreciation Unit Of Production Method

It provides a couple different methods of depreciation.

. Depreciation Calculator License Key Full Allows you to calculate depreciation using three methods. If I sum all of the shaded values in the Q13 column and calculate it as a proportion of the total shaded sum the total depreciation for expenditure incurred in Q2 to Q13 for Q13 to Q24 I. Percentage Declining Balance Depreciation Calculator.

The calculator allows you to. This depreciation calculator is for calculating the depreciation schedule of an asset. The depreciation of an asset is spread evenly across the life.

Table of depreciation. The depreciation method is a way to spread out the cost of a long-term business asset over several years. The calculator should be used as a general guide only.

Calculate the depreciation expenses for 2012 2013 2014 using a declining balance method. The formula for calculating appreciation is as. This calculator uses the units-of-production UOP depreciation method to compute both the depreciation per unit and total annual depreciation for an item given the items original.

There are many variables which can affect an items life expectancy that should be taken into. Depreciation Calculator user reviews from verified software and service customers. Useful life 5.

The units of production depreciation calculator designed by iCalculator does the complex calculations for you with just a fraction of the effort that it takes for performing calculations. The depreciation is more for the period in which. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation.

So it helps the accounting software to exactly calculate the yearly depreciation of different assets as different rates are fitted for different assets. Under this system a fixed percentage of the diminishing value of the asset is written off each year so as to reduce the asset to its. Dn rate of different assets is different.

Explore ratings reviews pricing features and integrations offered by the Fixed Asset Management. Compare Depreciation Calculator alternatives for your business or organization using the curated list below. The straight line calculation as the name suggests is a straight line drop in asset value.

The formula of the depreciation and appreciation is the same rates are either below zero depreciation or above zero appreciation. Straight line depreciation percent 15 02 or 20 per year. This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods.

SourceForge ranks the best alternatives to Depreciation Calculator in. Depreciation per year Book value Depreciation rate. For example if you have.

In other words this method is preferable where the life of the asset is mostly dependent upon its usageproduction volume.

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

Units Of Production Depreciation Calculator Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

How Do I Calculate Depreciation Formula Guides Examaples

Depreciation Formula Examples With Excel Template

Unit Of Production Depreciation Method Formula Examples

Double Declining Depreciation Calculator Efinancemanagement

The Units Of Production Method Of Depreciation Part 1 Of 2 Youtube

Depreciation Formula Examples With Excel Template

Depreciation Formula Examples With Excel Template

Depreciation Calculator Definition Formula

Calculate Depreciation With Units Of Production Method Depreciation Guru

Units Of Production Depreciation Method Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense